Question 1 (a)

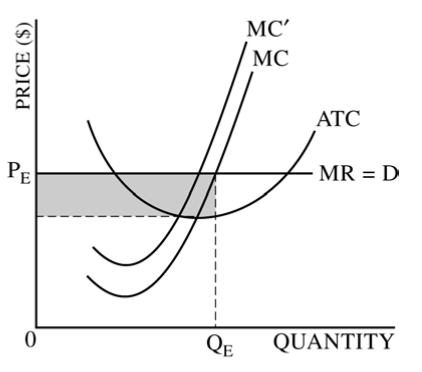

- Profit per unit = Demand(Price) - ATC

Question 1 (d)

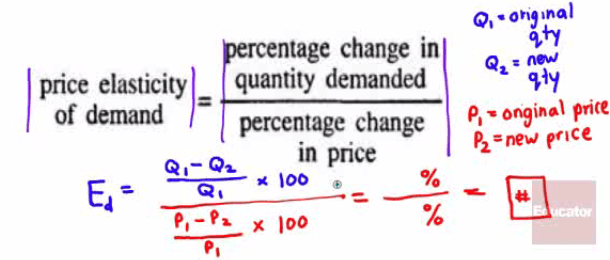

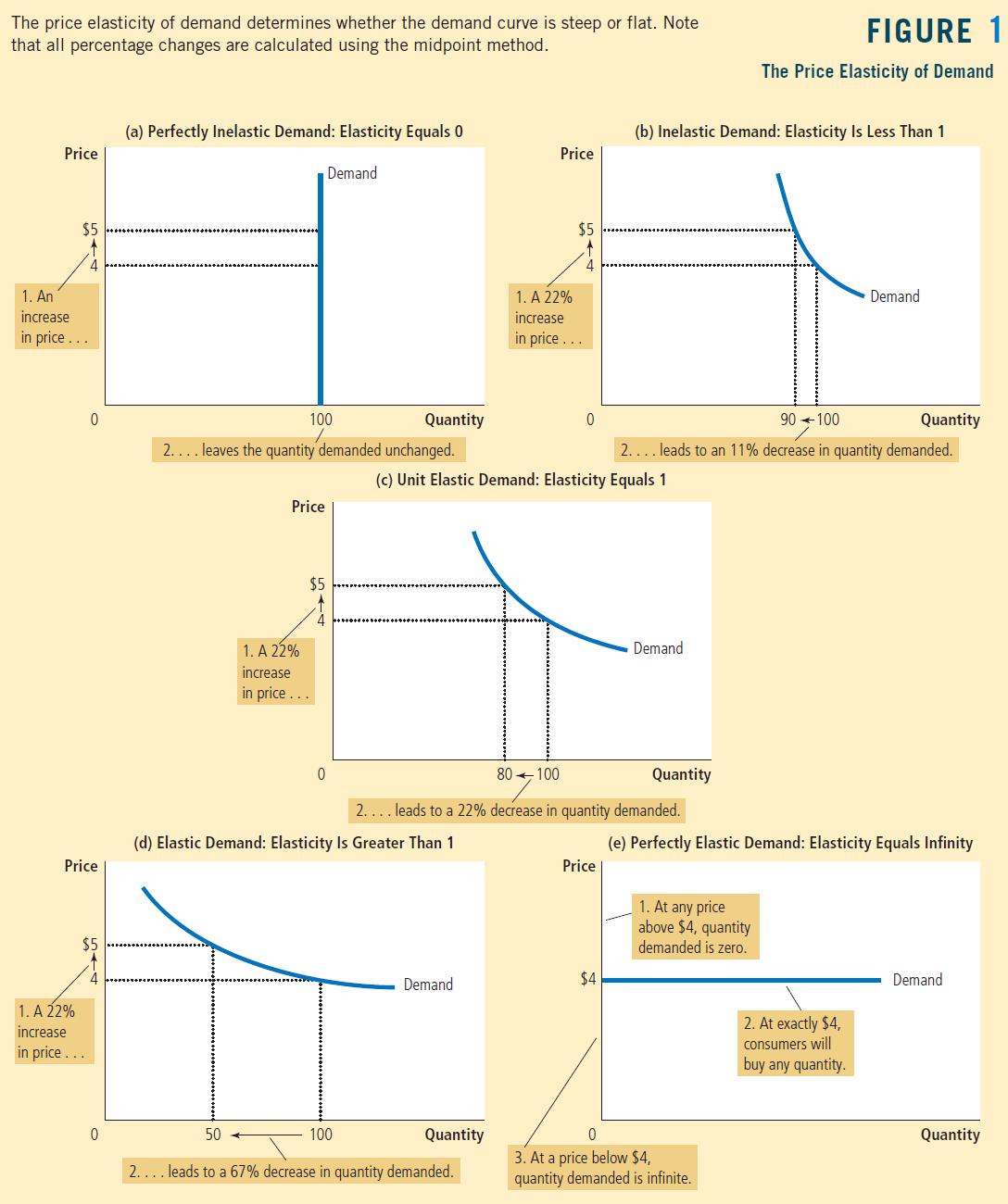

Formula

How to remember

- Queen is greater than the Princess

Question 1 (e)

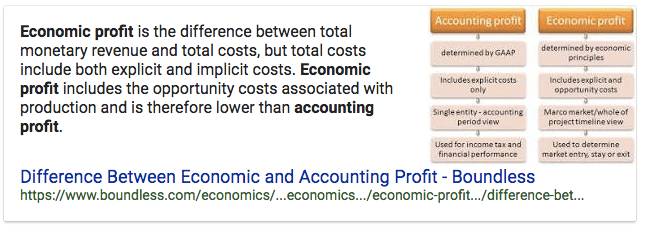

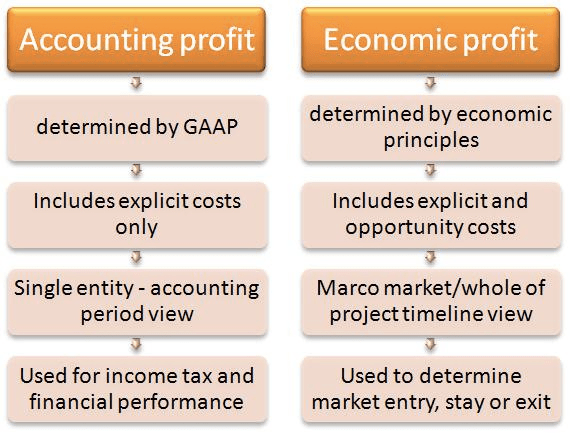

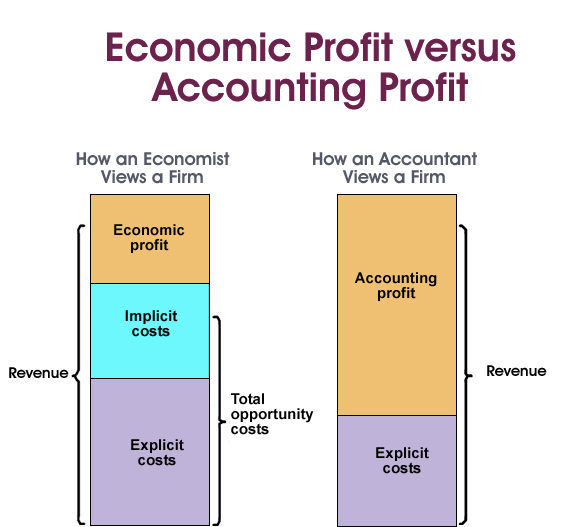

Accounting Profit ≥ Economic Profit

Question 1 (f)

- Profit = Revenue - Cost

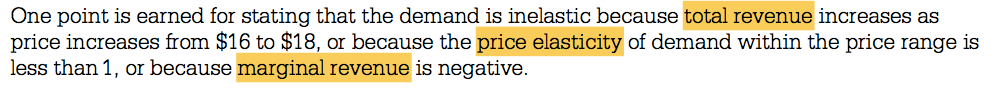

Question 2 (a)

Graph for a typical firm should include

Marginal Cost

Marginal Revenue

Demand(Price)

Average Total Cost

Profit = (Price - ATC)* Quantity

Question 2 (c)

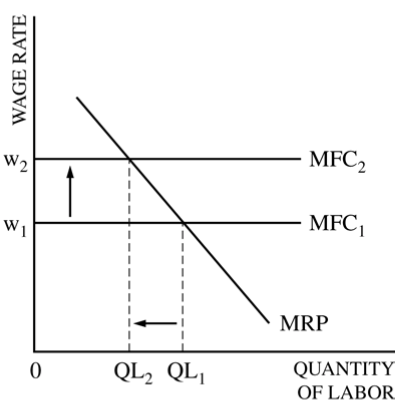

A typical labor supply and demand graph should include

Marginal Factor Cost: Horizontal

Marginal Revenue Product (Marginal Product of Labor): Downward sloping

x-axis: Quantity of Labor

y-axis: Wage Rate

Question 3 (a)

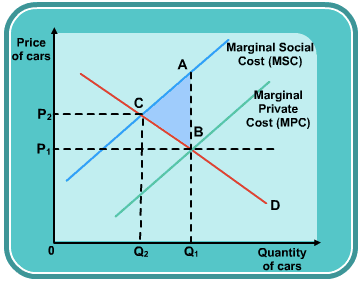

Negative Social Externality

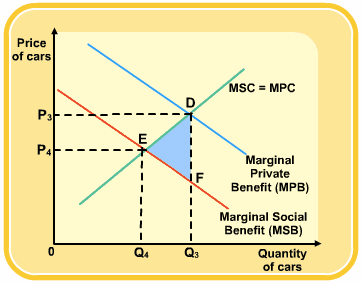

Positive Social Externality

Question 3 (b)

- A lump-sum tax will not change the deadweight loss, since the MC will not change